Amazon is not just about shopping with some of the best credit cards available today. It may have only been founded in 1994, but it has become a powerhouse in the time since, making a name for itself with free two-day shipping. With the launch of its credit cards, Amazon has commanded an even larger share of the market.

The best Amazon credit cards offer competitive APRs, no annual fees, and bonus rewards and protections that make Amazon credit cards an excellent fit for your shopping needs.

Now is a great time to get an Amazon credit card since Amazon Prime Day is coming up on July 12 and 13. By joining Amazon Prime, cardholders can earn 6% back during the Prime Day sales event, as well as 5% or 2% on Amazon for the rest of the year.

Which is the best Amazon credit card?ZDNetcan help you decide.

card highlights intro bonusGet a$150 Amazon Gift Card instantly upon approval exclusively for Prime membersAPR19.49% - 27.49% Variablerecommended creditExcellent/Goodreward rates

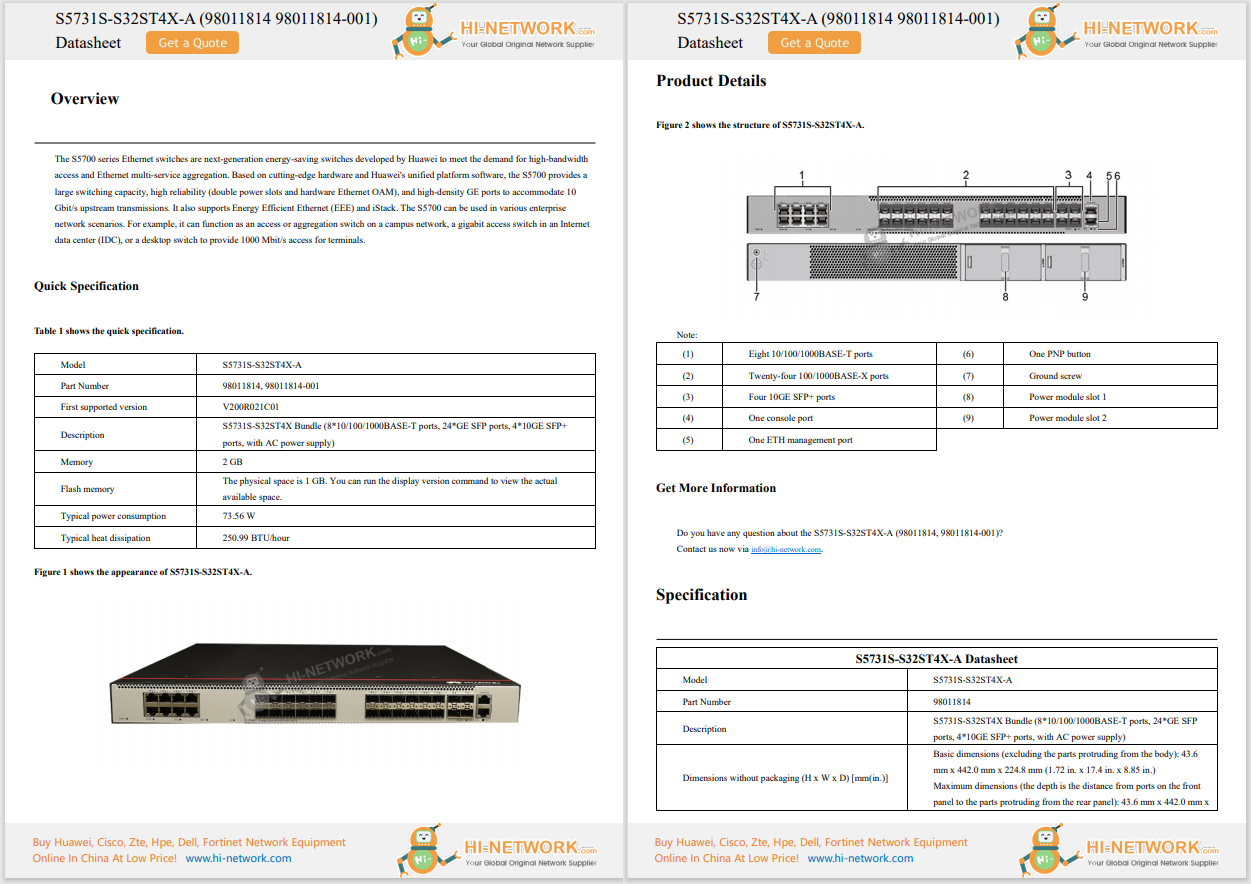

card highlights intro bonusGet a$150 Amazon Gift Card instantly upon approval exclusively for Prime membersAPR19.49% - 27.49% Variablerecommended creditExcellent/Goodreward rates The Amazon Prime Rewards Visa Signature Card is our pick for the best Amazon credit card. It starts off strong with a$100 Amazon Gift Card that is delivered right upon approval. There is also an introductory offer giving 10% back on certain products. You receive regular rewards, too, including 5% cash back on purchases made at Amazon and Whole Foods Market.

There is also 2% back when you make purchases at restaurants, gas stations, and drugstores, plus 1% back on utilities, rideshare services, and all other purchases you make. Some products give 10% back or more. When it comes time to pay, there is the option of either a 0% APR for six to 18 months when you spend$50 or more. You will need a Prime membership to benefit from this rewards card, but for many, it is well worth it given the rewards rates.

Pros | Cons |

|

|

card highlights intro bonusGet a$125 Amazon Gift Card upon approval for the Amazon Business Prime American Express Card.APR19.49% - 27.49% Variablerecommended creditExcellent/Goodreward rates

card highlights intro bonusGet a$125 Amazon Gift Card upon approval for the Amazon Business Prime American Express Card.APR19.49% - 27.49% Variablerecommended creditExcellent/Goodreward rates If you own a business, the Amazon Business Prime American Express Card also rewards you on your purchases. You can choose your choice of either cash back or special financing terms. If you choose rewards, you will receive 5% cash back on domestic purchases made at Amazon, Whole Foods Market, and AWS, up to$120,000 per year. There are also extra rewards, like 2% cash back at restaurants, gas stations, and even your wireless telephone bill. All other purchases garner 1% cash back. Rewards are valid up to your first$120,000 in purchases.

If you choose 90-day terms, you receive interest-free financing for 90 days, saving you precious dollars on your purchases. Either way, there is a$100 bonus statement credit once you spend$3,000 in purchases within your first three months of having the card. However, like the Amazon Prime Rewards Visa Signature Card, you will need a Prime membership in order to be eligible for this card.

Pros | Cons |

|

|

card highlights intro bonusGet a$60 Amazon Gift Card instantly upon approvalAPR29.99% Variablerecommended creditExcellent/Good Creditreward rates

card highlights intro bonusGet a$60 Amazon Gift Card instantly upon approvalAPR29.99% Variablerecommended creditExcellent/Good Creditreward rates The Prime Store Card is the best Amazon credit card for financing options. You can swap your cash back rewards for special financing, instead. When you shop on Amazon, you can receive 0% APR based on the amount you spend.

There is 5% cash back on all of your Amazon purchases when you have a valid Prime membership. There are also rotating categories that give you anywhere from 5% to 15% in cash back. You have the option of redeeming your cash back as either cash back toward your Amazon purchases or a statement credit for better convenience. As an introductory bonus, there is a$60 gift card awarded upon approval of your card. To help you pay that bill, there is also 0% APR financing that allows you to pay over time instead of upfront.

Pros | Cons |

|

|

card highlights intro bonusN/AAPR10.00% Non-variablerecommended creditNo Creditreward ratesN/Aannual feeN/Aintro purchase APRN/A

card highlights intro bonusN/AAPR10.00% Non-variablerecommended creditNo Creditreward ratesN/Aannual feeN/Aintro purchase APRN/AThe Amazon Prime Secured Card gives those with poor credit a chance to still have a credit card while rebuilding their credit. This is a card made for Amazon by Amazon, giving you the opportunity to rebuild your credit while you make your regular purchases on Amazon.com, as well as its physical stores.

You will need to pay a deposit upfront, which can be anywhere from$100 to$1,000 and payable in$50 increments. Once you do that, you will receive 2% on your Amazon purchases when you have a valid Amazon Prime membership. The Amazon Prime Secured Card also gives you access to excellent credit tools, offering up free access to your credit score and credit-building tools and resources to help you along. After you rebuild your credit to satisfactory levels, you can transition to an unsecured credit card.

Pros | Cons |

|

|

The best Amazon credit card is the Amazon Prime Rewards Visa Signature Card for its generous rewards, competitive APR, and regular cash back. Plus, you receive an introductory gift card upon activation, plus elevated cash back as a welcome.

It can be difficult trying to differentiate between so many options for the best Amazon credit card. These are our expert recommendations to help.

Choose this product... | If you want... |

Amazon Prime Rewards Visa Signature Card | A card designed to reward Prime members |

Amazon Business Prime American Express Card | Rewards for your business |

Prime Store Card | To finance your Amazon purchases |

Amazon Prime Secured Card | To build your credit |

In searching for the best Amazon credit cards, there are several factors we consider.

The APRs for the best Amazon credit cards range from 10% to 26.74%, depending on which Amazon credit card you choose.

Amazon credit cards require a credit score ranging from poor to excellent credit, which means there is something for everyone.

Amazon has a limited number of credit cards but if you are interested in receiving rewards for your Amazon purchases, consider some of our picks for the best rewards credit card.

For more recommendations on credit cards, check out our expert picks for the best high-limit credit cards and the best international travel credit cards.

Hot Tags :

Our process

Finance

Credit Cards

Hot Tags :

Our process

Finance

Credit Cards