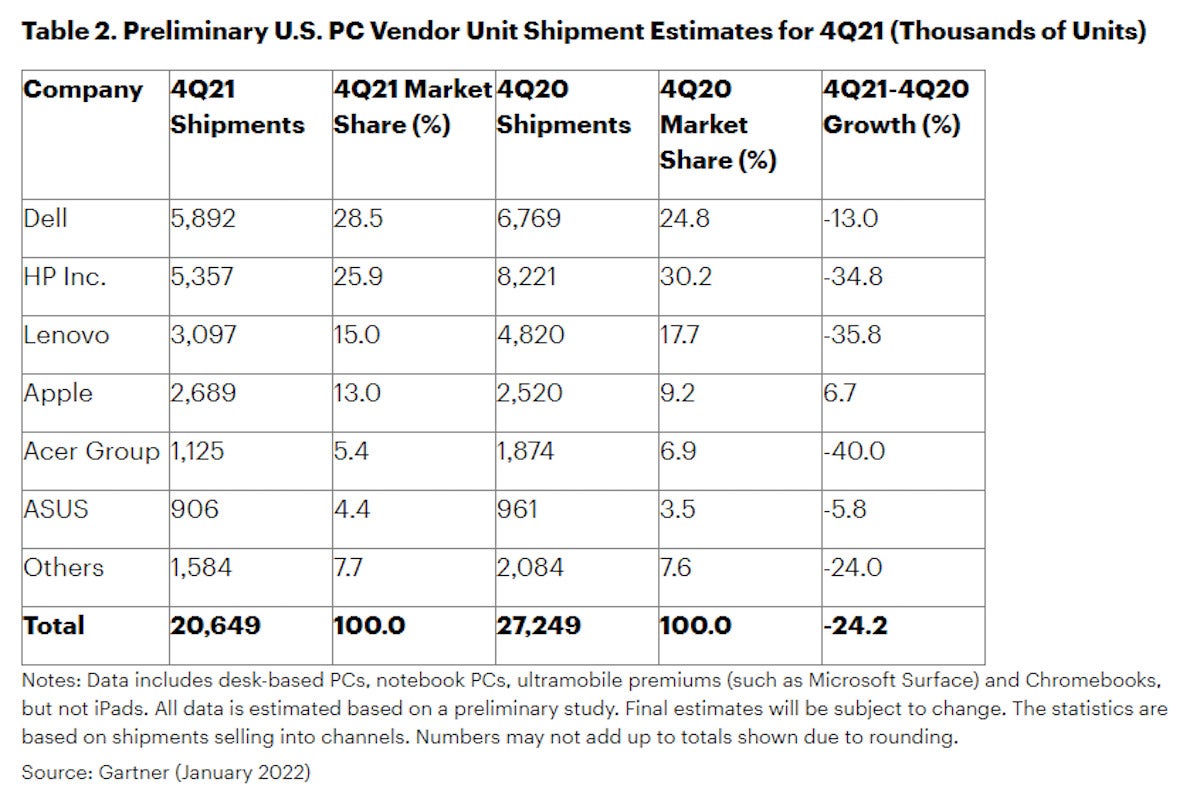

The US PC market saw its second consecutive quarter of double-digit decline during the fourth quarter of 2021, with shipments dropping 24.2% year-over-year.

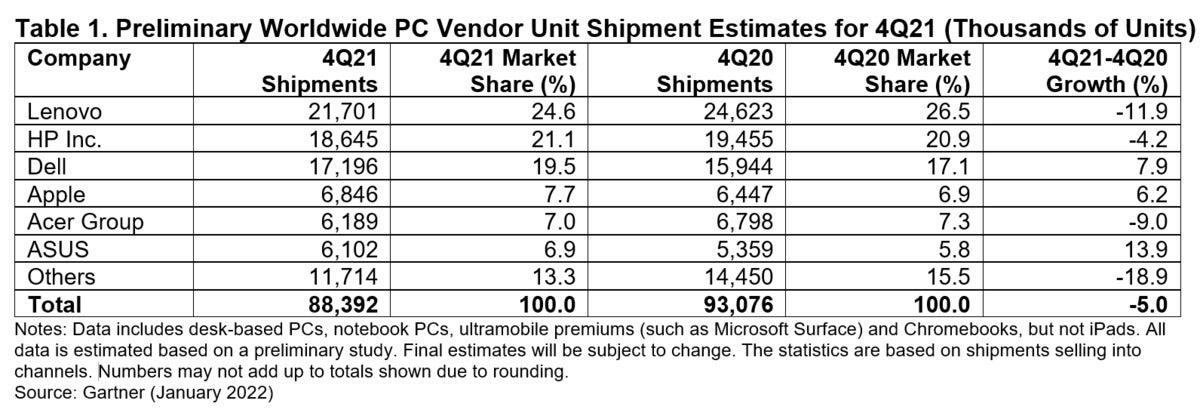

Worldwide PC shipments totaled 88.4 million units in Q4 2021, a 5% decrease from the fourth quarter of 2020, according to Gartner's preliminary results.

The decline marked the first year-over-year drop following six consecutive quarters of growth, according to Gartner Research, which just released a report on PC sales.

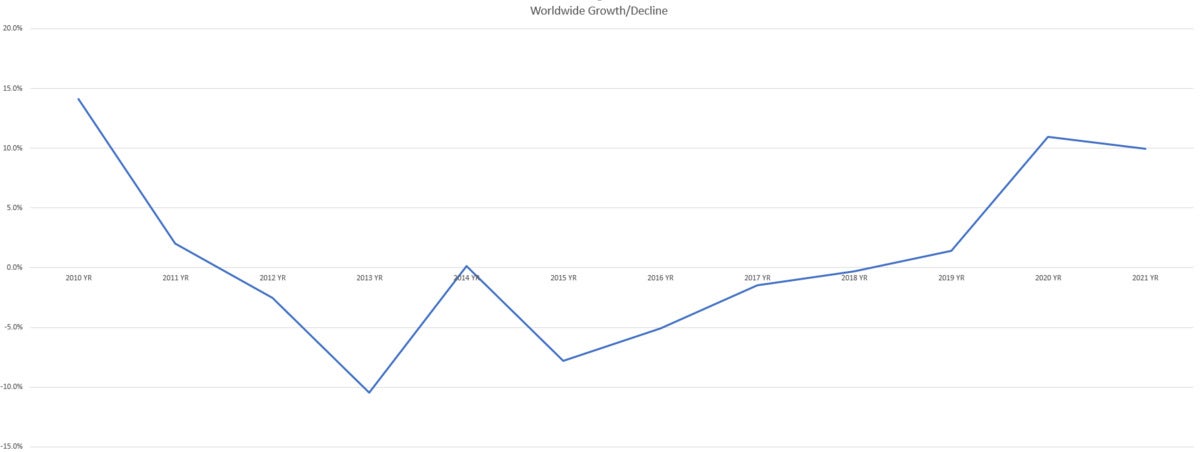

As a whole, PC shipments in 2021 remained positive, reaching 339.8 million units - up 9.9% over 2020.

The slump in sales over the second half of 2021 is being attributed to shipping problems and semiconductor shortages, the same problems affecting other markets, according to Gartner. Lead times for some PCs are extending to as long as four months.

"Without the shipment chaos in early 2020, this quarter's growth may have been lower," said Gartner Research analyst Mikako Kitagawa. "While this may lead to lower shipment numbers, it is still reasonable to conclude that PC demand could remain strong even after stay-home restrictions ease. Moving forward, vendors and suppliers will be closely balancing the need to meet underlying demand without creating excess inventory."

In the first quarter of 2021, Chromebook shipments grew by triple digits compared to the previous year, with growth primarily driven by investment among educational institutions in North America. Including Chromebooks, the total worldwide PC market grew 47% year-over-year in Q1.

Prior to the pandemic, the PC market had experienced a steady decline that began in 2012 and was only intermittently interrupted by modest growth. In 2019, PCs saw their first weak uptick in sales, growing just 1.4% year-over-year; that was driven by a Windows 10 refresh and the end of Windows 7 support.

When the pandemic hit in 2020, it revived the PC industry. PC sales jumped by 11% that year. "The Pandemic was a game changer for the PC industry," Kitagawa said.

The COVID-19 pandemic changed PC sales in three major ways:

Gartner Inc.

Gartner Inc. Prior to the pandemic, PC sales had been steadily declining.

Gartner expects PC demand to slow for at least the next two years, but annual shipment volumes are not expected to decline to pre-pandemic levels.

"We believe that PC demands in enterprise market will continue to be strong throughout the year. But the shipments will be slow because of the longer lead time due to the supply chain issue," Kitagawa said. "The lead time is pretty long right now. PCs ordered this quarter may only be shipped in the next quarter."

Along with supply chain issues, Chromebook sales began to slump last year, Kitagawa explained.

The decrease was largely driven by weak shipments as demand from educational institutions continued to slow, Gartner said. On top of that, the holiday season also saw weaker PC sales than in 2020 due to modest consumer demand.

The top three vendors in the worldwide PC market remained unchanged from the previous quarter, with Lenovo maintaining the top spot by shipments. All of the top six vendors experienced double-digit growth in all of 2021, and all, except Dell, gained market share compared to 2020.

Gartner

Gartner PC vendors market place didn't change in 2021, even though Lenovo suffered the greatest loss in sales.

The decline over the past two quarters was highlighted by Lenovo's inability to supply PCs to enterprise customers due to supply chain issues, according to Gartner.

In the US market, Dell secured the top spot based on shipments, with 28.5% market share. HP followed with 25.9%.

Lenovo's worldwide PC shipments fell nearly 12% in the fourth quarter of 2021, the first period of year-over-year decline for the company since the first quarter of 2020. HP's shipments fell by 4.2% in the last quarter. Lenovo's slowdown was also attributed to slow Chromebook demand and branding issues in China.

Gartner

Gartner Dell maintained its lead in US PC sales.

Lower demand for Chromebooks and shipping delays also contributed to HP's year-over-year decline; that decline, however, was tempered by robust growth in the Asia Pacific market, Gartner said.

"HP's supply chain got improved this quarter from very bad conditions in the past few quarters," Kitagawa said.

Conversely, Dell gained market share this period after notching a fifth consecutive quarter of growth. Shipment volume exceeded 17 million units for the first time in the company's history, led by strong performance in Latin America, EMEA and Asia Pacific.

Dell didn't suffer as much from slumping Chromebook demand as it is not a big player in that market. Also, softness in the consumer market did not markedly affect Dell because of its smaller presence there; Dell targets only selected segments such as gaming and the premium segment, Kitagawa said.

Hot Tags :

Laptops

dell

hp

Desktop PCs

Lenovo

Chromebooks

Hot Tags :

Laptops

dell

hp

Desktop PCs

Lenovo

Chromebooks