Americans are stressed.

Along with the coronavirus pandemic, the tug-of-war from social and political issues, the canceled flights, and the high gas prices, there's yet another more frustrating and frightening factor causing anxiety for millions of Americans right down to their pocketbooks: Theeconomy.

Thefirst half of 2022 has been a torturous and tumultuous period for the US stock market, the worst since 1970.Through June 30:

Americans are stressed.

That stress is reflected among American workers who, last year, were eager to regain control over their lives and their finances in the ebb of the pandemic, but this year find themselves overwhelmed by higher prices at the grocery store and lower borrowing power with higher interest rates. Raises and bonuses, if any, are feared by many workers as not enough to rise above inflation and provide the means to a comfortable living.

In a survey recently released by San Francisco-based fintech SoFi, 75% percent of US employees surveyed said they're stressed about their finances. Nearly half (40%) said they worry about inadequate retirement savings, one-third feel the weight of credit card debt and more than one-quarter (29%) said they're stressed about not having enough money to pay for their mortgages, rents, or food. (The survey, conducted by SoFi and Workplace Intelligence surveyed 800 human resource leaders and 800 full-time employees between ages 18 and 74 from December 20 and 29, 2021.)

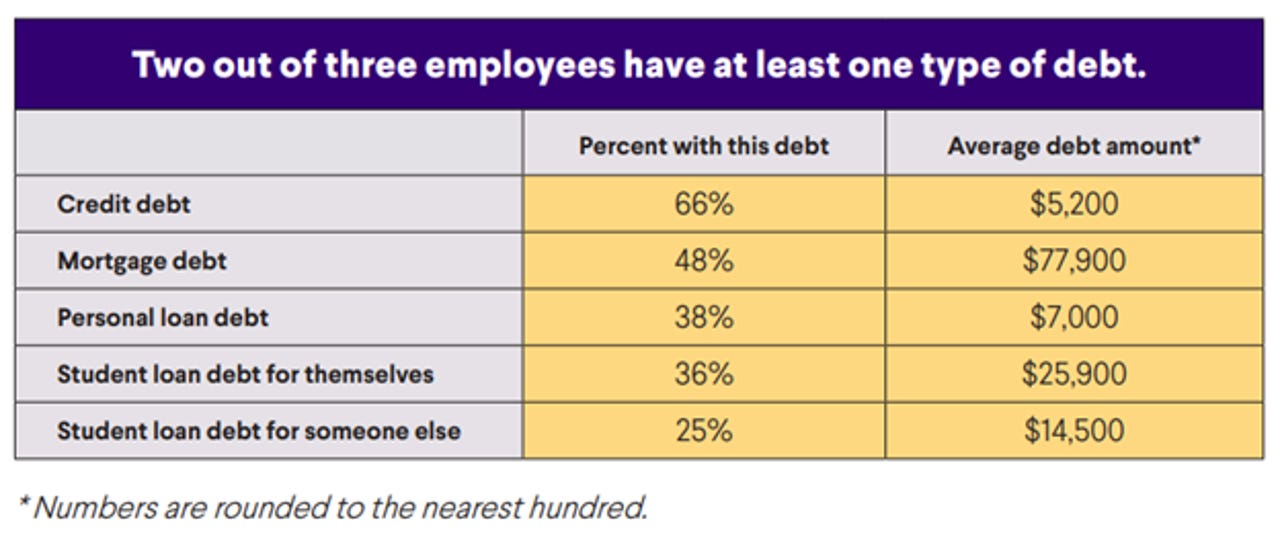

As for debt, two-thirds of employees in the survey said they grapple with some form of it, be it credit card, mortgage, personal loan, or student loan (either for themselves or for someone else). And this stress over debt is felt among various income groups, including the rich. In fact, more than half (57%) of those surveyed who are high-income earners making more than$150,000 a year said they have at least one form of major financial stress.

SOURCE: "The Future of Workplace Financial Well-Being: 2022 Employer & Employee Perspectives", SoFi at Work.

SOURCE: "The Future of Workplace Financial Well-Being: 2022 Employer & Employee Perspectives", SoFi at Work. For Brian Walsh, Senior Manager of Financial Planning at SoFi at Work, and a Certified Financial Planner (CFP), there are two key areas at the root of the financial stress of Americans. "Number one relates to getting by with their day-to-day finances, because the biggest connection between personal finances and financial stress and well-being is not only the ability to pay their month-to-month expenses, but having a cash cushion to cover the unexpected. And from what we've seen generally that tends to be depleted," Walsh said in an exclusive interview withZDNet.

"The second key area is related to uncertainty and volatility in the market and it's really hard to disconnect the two even though a majority of people we work with are investing for the long term where it's easy to say 'hey, we care about the balance decades from now -not days from now.'" That's easier said than done. Even experienced investors who know they're in it for the long haul aren't immune from the stress of seeing their balances diminish during a time of economic uncertainty. "Those are the two biggest areas that we're seeing right now," he adds.

The stress that employees experience from poor financial well-being ultimately affects their employers. Financial stress, the survey revealed, has impacted employees in various ways: 38% say it has worsened their sleep, while 36% say it has affected their mental health, and 27% on their physical health. What's more, a quarter of employees surveyed said financial stress has crippled their motivation to pursue personal goals, while 22% said their relationships have been affected by it. In the workplace, be it in the office or at home, nearly one in five employees (23%) said they've had trouble focusing and 18% have had issues with their productivity.

Ultimately, this fear costs employers in lost time. Employees spend nine hours per week dealing with their personal financial issues; that's one full day of work per week or 60 workdays (12 weeks) per year. To combat lost time, and money, the survey suggests that employers need to step up to better support their employees with resources to help them take charge of their financial well-being.

NOTE:Although SoFi's survey was conducted in late December 2021, well before the latest rise in inflation and decline of financial markets, SoFi maintains that its survey findings remain relevant and applicable well into this year.

Despite the deepening economic challenges, employees surveyed are motivated to take charge of their finances. The SoFi survey found that 91% of the 800 workers surveyed said they have financial goals they want to achieve, the top ones including paying off credit card debt (39%), saving for retirement (38%), building an emergency fund (27%), saving for a personal expense (27%), saving for their children's education (19%), and investing in stocks, bonds, or mutual funds (19%).

And given this drive, the time is now for employers to enhance their benefits. The survey posed questions to the 800 HR leaders surveyed about what current financial benefits they offer to their employees, such as contribution benefits, financial resources, and education tools. More than three-quarters (77%) said they offer such resources. The survey revealed that of the top five benefits, 70% of companies surveyed say they offer retirement matching/401(k), 69% offer financial planning tools, 63% offer access to a financial planner/advisor, 61% offer financial education, seminars, or courses, and 58% offer budget planning tools.

Employees, motivated to take charge, seek many of the benefits employers say they offer. Of the employees surveyed, 64% want employers to provide benefits to help them build an emergency savings fund as well as retirement matching, while 62% want financial planning tools and 61% want budget planning tools. What's more, 60% want homeownership assistance.

But why is there a disconnect between what employers say they offer versus employees who feel they don't have such benefits? The SoFi survey revealed that an average of 38% of employees aren't using their benefits mainly because of two factors: quality of benefits and awareness. Twenty-three percent of workers said their financial benefits are "poor" while 21% say they don't know how to get started using them. What's more, 19% say they didn't know such benefits existed. Communication is an issue between employers and employees. Half of the employees, and nearly one-third of HR leaders, surveyed say their company rarely, or never, communicates with workers about their financial benefits and well-being.

Employees surveyed say they want their companies to invest in new, and better, benefits to help them improve their personal finances and at least eight out of 10 employees believe that financial well-being benefits will have a positive impact on some of the most important aspects of their jobs and well-being, including their productivity (86%), job satisfaction and engagement (84%), mental health and stress levels (84%), desire to stay with their employer (86%), ability to focus (84%), and their physical health (80%).

Fortunately, there are indications of improvement. Company budgets, for example, are growing, and over the next year or two, 94% of HR leaders surveyed said they will have a budget for employee financial well-being benefits and three-fourths said their budgets will increase.

Despite the drive among full-time American employees to pull themselves up by their financial bootstraps, there are steep obstacles ahead in the form of rising inflation, higher interest rates, and fears of a looming recession. To complicate matters for those working in the tech sector, the threat of layoffs compounds anxiety. Although that's unfortunate, Walsh notes that the unemployment rate is at, or near, record lows, currently 3.6% as of May.

Walsh and his team are seeing more strain from SoFi members concerning expenses related to housing, transportation, and childcare. "Housing especially is getting worse with the recent spike in interest rates where we're now talking to people who have wanted to move but now have golden handcuffs because their 30-year mortgage is less than 3% but there's no way in the world they're taking out a 6.25% mortgage. Even people who did new construction projects, where they applied for a loan and signed a contract; since then, interest rates have doubled and now they can't afford the house," Walsh notes.

SoFi has provided one small silver lining to the cloud of rising interest rates. Last week, it announced that the APY for its SoFi Checking and Savings account was raised to 1.50% for members who have a direct deposit account. That's the highest rate available; the national average for savings accounts is 0.1%, according to Bankrate. (For SoFi members without direct deposit, all balances will earn 0.90%.) The rate increase to 1.50% is in reaction to the Federal Reserve's second interest rate hike of 75 bp (or 0.75%) in mid-June, the highest rate hike since 1994.

But no analysis of the current state of the economy would be complete without a section devoted to solutions to help people weather the choppy waters of economic uncertainty. Walsh shared withZDNetsome of his observations and takeaways for people to keep in mind as we enter the second half of the year?

For first-time homebuyers yearning to get approved for a mortgage, Walsh recommends sticking to your budget and not striving for what you think you could potentially get approved for. "We've always been a big proponent of backing into your purchase price from your actual budget I think a lot of times people start with a high-level rule of thumb, or maybe they look at what they could potentially get approved for," he says. "Both those numbers are typically much higher than what will fit comfortably in a budget while still allowing you to save and pay down debt, among other things."

It's easy to spend money, especially when you make instant charges from your smartphone or an impulse buy from one of your many online retail accounts. Technology is your shopping enabler. But Walsh notes that we can use technology in our favor to "trick" us into being more responsible in managing our pocketbooks online. "Technology makes it so you can automate a lot of things, so you can link your account and get alerts through a platform such as SoFi Relay, so that if you overspend, [an alert] pops up in the palm of your hand and you get that note saying to tone back spending." Relay is SoFi's one-stop-shop for tracking your money, from getting credit score monitoring, spending breakdowns, and financial insights -- free of charge.

Let's face it, gas prices aren't going down soon, at least not to the more comfortable levels of$3 a gallon that we experienced last year (the current national average for the price of a gallon of gas is$4.81, according to AAA). Walsh notes that although people can absorb extra expenses while focusing on ways to decrease expenses in other areas, they run the risk of cutting their noses off to spite their faces.

Take saving on gas as an example. Summertime is peak driving season when families travel to visit friends and relatives, and to take vacations. But this summer some people are passing up on trips because of the price of gas. "We're trying to make sure that people don't overreact to a situation and potentially put themselves in a tougher situation," Walsh says. One example he provides is buying a brand new fuel-efficient or electric vehicle, even though your current automobile has several years left of vim and vigor. "We don't want people overreacting to a small expense going up by making a really big purchase and making larger monthly payments," he added.

Keeping your spending in check during these trying economic times isn't easy, but every little bit helps. What Walsh and the team found helpful is reevaluating the concept of convenience. Shopping online, for example, is fast, convenient, and gives one instant gratification, which results in spending money. To curb your shopping enthusiasm, Walsh recommends implementing a waiting period. "It can be 24 to 48 hours before you buy something over a certain dollar amount; something like that -- as silly as it sounds -- helps people spend less money."

Walsh also recommends checking the prices on "convenient" resources such as Uber versus taking a taxi, or food delivery services versus picking up directly. "If you look at a lot of these services that have added convenience, they started out being really low-priced. I remember when Uber used to be super cheap compared to taking a taxi; now that's reversed depending on where you're located, so you have to ask is the convenience worth it? Sometimes it is, sometimes it isn't," he says.

There's no going around it, people react emotionally to investing. Whether it's your stock portfolio, your 401(k), or your investment in Bitcoin (or any altcoin), the moment the markets take a dip, and the value of your investments drop, it's easy to freak out by pulling out. But the reality is that markets do fall -- sometimes into bear market territory (sometimes worse) -- and as history has shown, the markets recover, rising to new heights. Consider the S&P 500 index. From its inception in 1926 through December 31, 2021, the average annualized return has been up 10.5%. That includes the Great Depression of 1929, the Great Recession of 2008, numerous bull and bear markets, corrections, double-digit inflation of the early 1980s, and even the global pandemic over the past two years. Despite the downs, the stock market remains strong and continues to move on an upward trajectory.

Walsh notes that the media is quick to amplify the small events affecting the daily performance of the markets, intensifying investor anxiety. The solution is simple: Don't overreact. "Any time I turn on the TV, or go on the internet or my Twitter feed, it's always 'the first time ever.'" Be it the Fed raising rates by 75 points -the first time ever since 1994 -- or the stock market dropping into bear market territory during the first half of the year -- the first time ever since 1970 -- there's always a first. "Yes, there are a lot of firsts, but at the same time volatility in down markets is a completely normal part of investing; it's the price you pay to achieve the highest long-term returns," he says. Walsh simply suggests investors should "zoom out." Don't look at your investments in one-week time horizons, but rather in three-, five-, 10- or 15-year horizons. After all, investors are in it for the long haul.

Americans may be stressed, but they're also resilient. Although the current economic condition is turbulent, shaky, and uncertain, we need not get caught up in the frenzy of every swing in the markets. Life is stressful enough, but by taking it one day at a time, being mindful of how we spend and better manage our money and consume resources and services, we might just be able to weather this storm and sail to calmer, more secure streams ahead.

Hot Tags :

Finance

Banking

Hot Tags :

Finance

Banking