Western Digital on Thursday reported better-than-expected second quarter financial results, in spite of supply chain disruptions and COVID-related challenges that continue to impact the business. Specifically, supply chain disruptions impacted cloud hard drive deployments at certain customers, which led to a sequential decline in exabyte shipments.

Overall, Western Digital's non-GAAP EPS was$2.30. Second quarter revenue was$4.83 billion, up 23% year-over-year.

Analysts were expecting earnings per share of$1.87 on revenue of$4.26 billion.

"I'm proud of the Western Digital team for delivering another quarter of strong results that exceeded guidance, even in the midst of ongoing supply chain disruptions and COVID-related challenges," CEO David Goeckeler said in a statement. "While we continue to experience strong demand across our end markets, these challenges continue to present a headwind to near-term results. We've executed well in building a solid foundation for future profitable growth driven by innovative products within our flash and hard drive businesses. As these transitory headwinds subside, we expect to emerge in a stronger position to drive better through-cycle results, creating value for our shareholders, employees and customers."

Western Digital

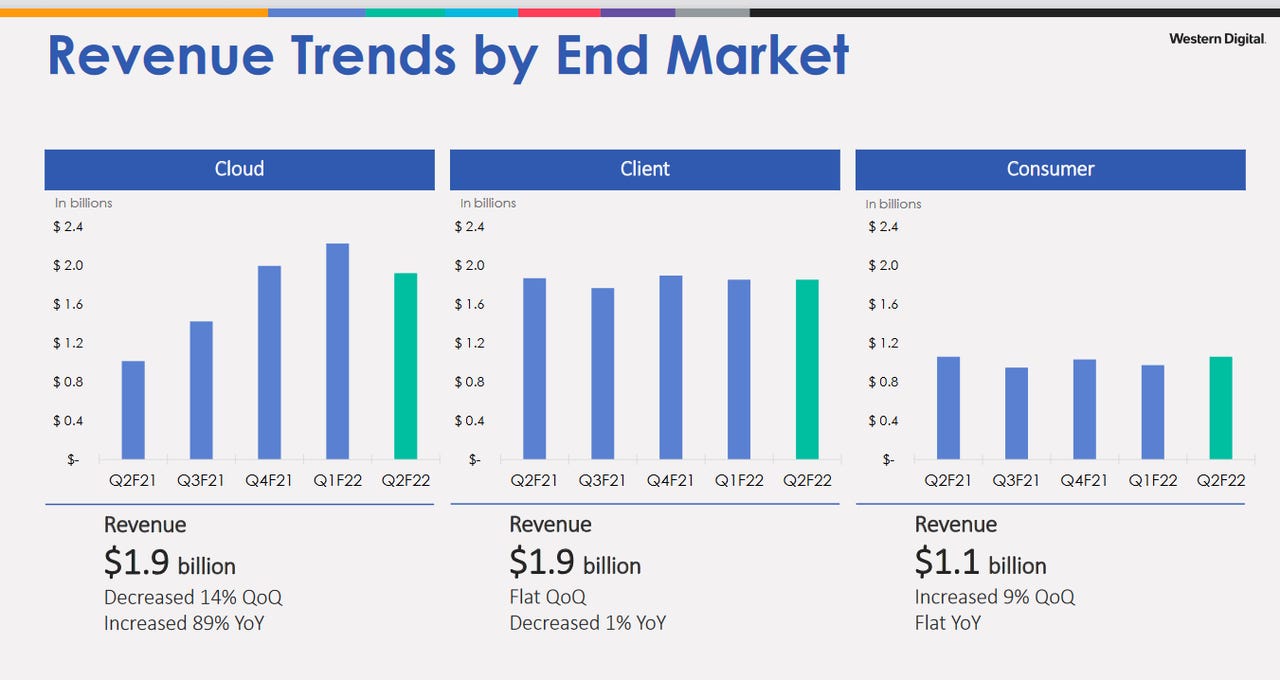

Western Digital Cloud revenue in Q2 came to$1.92 billion -- an increase of 89% over the year prior, but a 14% decline sequentially. While exabyte shipments were down sequentially, they were up more than 50% year-over-year. Western Digital credited the growth to "healthy overall demand for capacity enterprise drives, along with Western Digital's leadership position at the 18 terabyte capacity point." All told, cloud represented 40% of total revenue.

Client revenue came to$1.854 billion, representing 38% of total revenue. The segment's sales were flat sequentially and declined by 1% year-over-year. The continued ramp of 5G phones helped offset declines in both client SSD and client hard drive revenue. Within mobile, shipments of BiCS5 products into leading 5G smartphones increased over 60% sequentially and 50% year-over-year, led by strong content growth.

Consumer revenue in Q2 was$1.059 billion, representing 22% of total revenue. Sales were up 9% sequentially and flat year-over-year. Sequential growth was driven by retail flash sales during the holiday season. The WD_BLACK premium SSD product line, optimized for gaming, continues to gain momentum, with revenue increasing approximately 50% sequentially and doubling in calendar year 2021.

For fiscal third quarter 2022, Western Digital expects revenue to be in the range of$4.45 billion to$4.65 billion with non-GAAP EPS in the range of$1.50 to$1.80.

Western Digital on Wednesday also announced that CFO Robert Eulau will step down. Wissam Jabre will assume the role of Executive Vice President and Chief Financial Officer effective the week of February 7. Jabre has more than 20 years of experience in semiconductors and operations and was most recently CFO at Dialog Semiconductor. Eulau will remain with the company during an advisory period to ensure a seamless transition.

Hot Tags :

Tech

Computing

Hot Tags :

Tech

Computing