TaxAct

TaxAct The best software will never take all the pain out of tax filing, but it may come pretty close.

Reporting your 2021 taxes will become more complicated this year with things such as new kinds of tax credits for sick leave related to COVID-19, and small-business grants related to the pandemic if you run a business.

Some of that complexity can be smoothed over by using the very capable tax reporting package, TaxAct, by the software maker of the same name.

The program can take you through the questions and answer process of adding up your income, your expenses, and your special deductions, and then either electronically file for you, or print your forms for you to mail in.

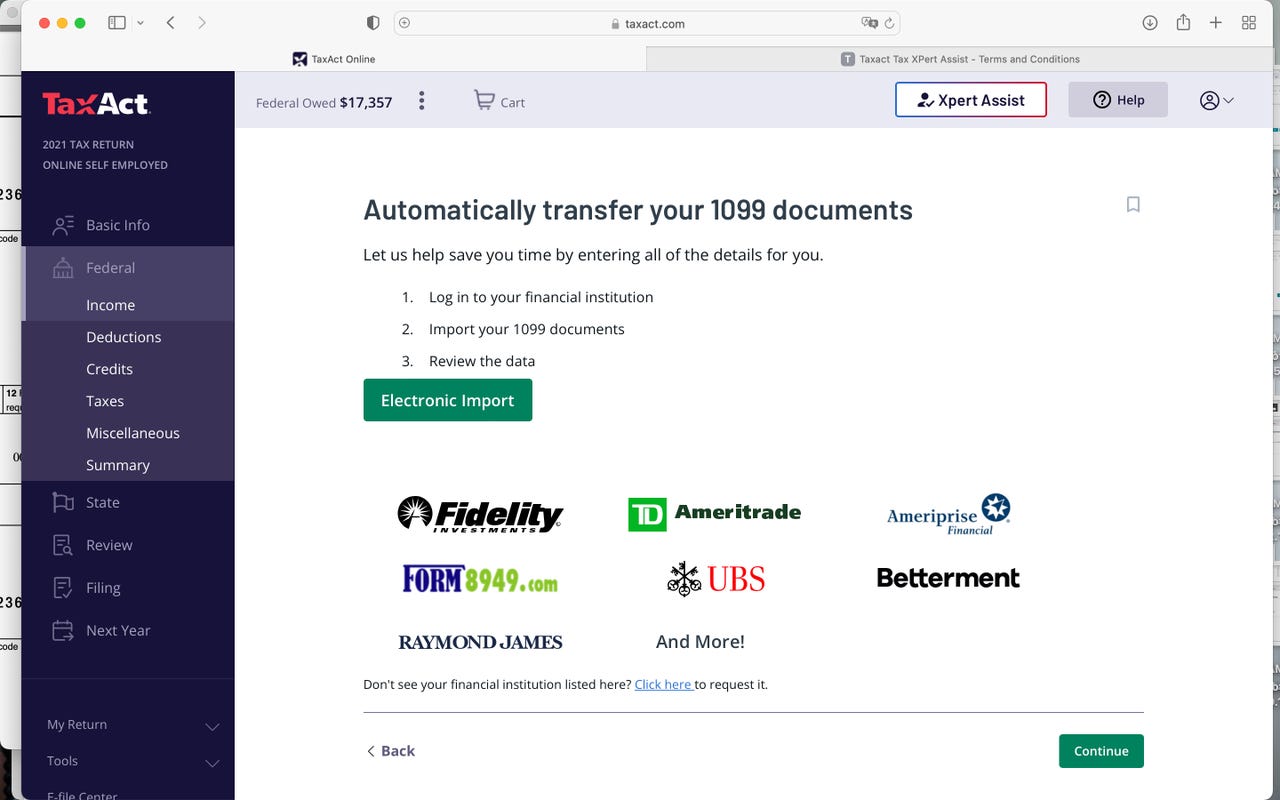

Some tax forms are not finalized and may not be for another month, but TaxAct will let you get very far along in the process in just a couple of hours. That is, assuming that you have at least a rough idea of what is going to show up on your W-2s and 1099s, and what your expenses are.

There's an extra incentive to get started now, which is that TaxAct is offering its live human CPA assistance, Xpert Assist, for free if you file by March 31.

TaxAct has essentially three categories of products: online, through a Web browser; Xpert Assist, the human-assisted version where a CPA will field questions online and also chat with you by phone; and the old-fashioned download route, where you get a desktop app that runs outside the browser.

The prices range from free online, to up to$139.95 for the self-employed downloadable software option that will handle things such as 1099s. State filings are extra for all the online products, at$34.95 to$44.95 per state filing. All the downloadable software products above the "Basic" version come with one free state filing, plus$50 for an additional state filing. There is also a "multi-state" add-on to the downloadable products, that will let you prepare multiple state documents, for$100.

The Xpert Assist function adds another$50 to$75 to the final price of the online products. However, at the moment, Xpert is being offered for free on all products, that it would otherwise be an add-on cost of$59 or more, but that's subject to change.

Also:Best tax software 2022: Self-employed and SMB options

Bear in mind, TaxAct has add-ons that you can purchase as an

Hot Tags :

Our process

Finance

Taxes

Hot Tags :

Our process

Finance

Taxes