Stripe

Stripe Stripe on Tuesday launched a new financial reporting tool that should simplify an accounting process that's often complex and time-consuming for SaaS businesses. The new Revenue Recognition tool automates the process of "recognizing revenue" -- documenting when a customer receives a product or uses a service rather than when they paid for it.

Revenue recognition is a key part of GAAP (Generally Accepted Accounting Principles) standards, but it presents a challenge for businesses with subscription-based or recurring revenue models. A SaaS business, for example, may have a customer who pays$120 on January 1 for an annual subscription -- but that revenue would be recognized as$10 each month for the next 12 months. For e-commerce businesses, revenue is recognized when a customer receives a product -- not when they pay for it or when it is shipped.

Typically, revenue recognition is a manual process that finance teams accomplish on Excel sheets.

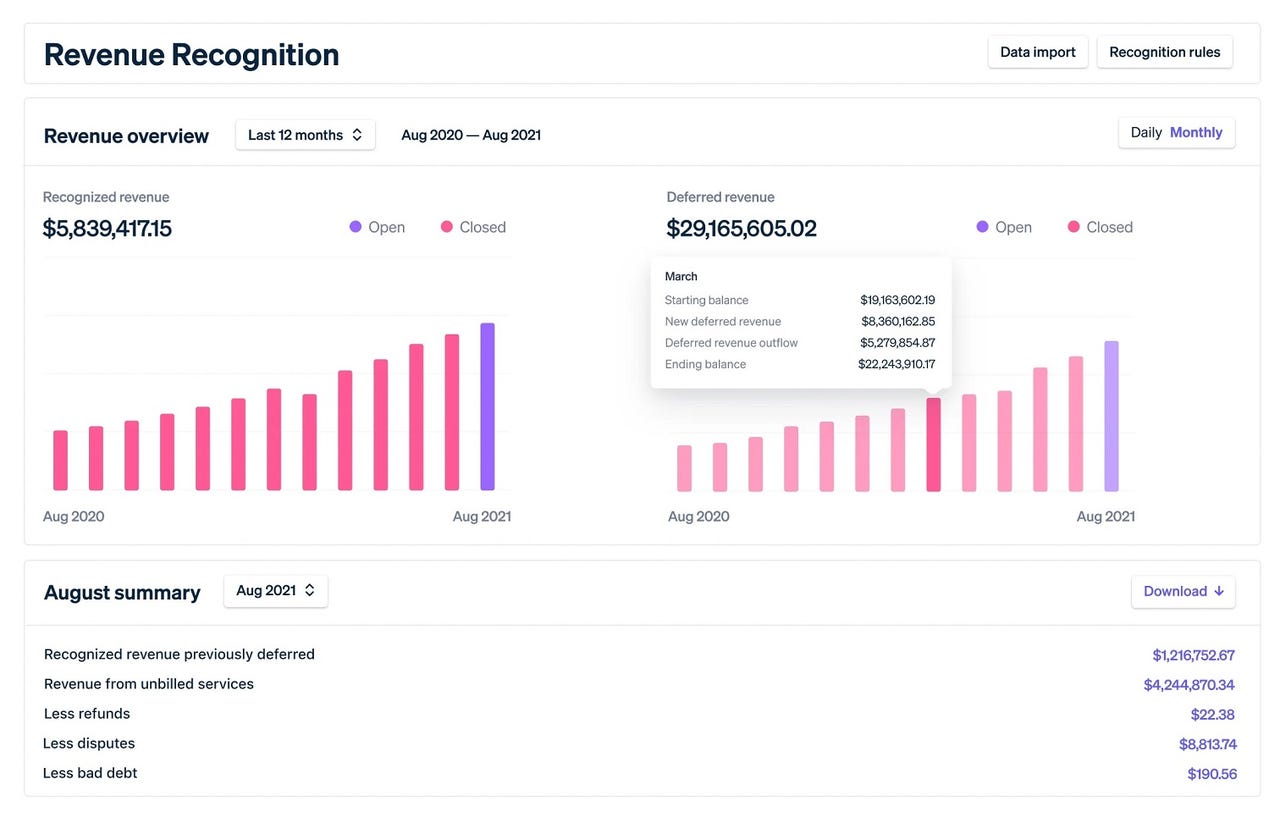

The new Stripe product provides reports like income statements and revenue waterfall tables. All transactions and payments changes occurring in Stripe are automatically accounted for in reports, and users can import non-Stripe transactions. It offers compliance support so businesses can meet global standards like ASC 606 and IFRS 15.

Revenue Recognition is the latest in a series of tools Stripe has rolled out for internet businesses, including its tax compliance tool Stripe Tax and Stripe Identity for identity verification. SaaS and subscription-model businesses represent large, quickly-growing markets for Stripe to pursue.

Revenue Recognition is now available to Stripe users in 40 countries around the world. Stripe already has thousands of early customers using the tool.

Hot Tags :

Finance

Hot Tags :

Finance