PayPal Holdings

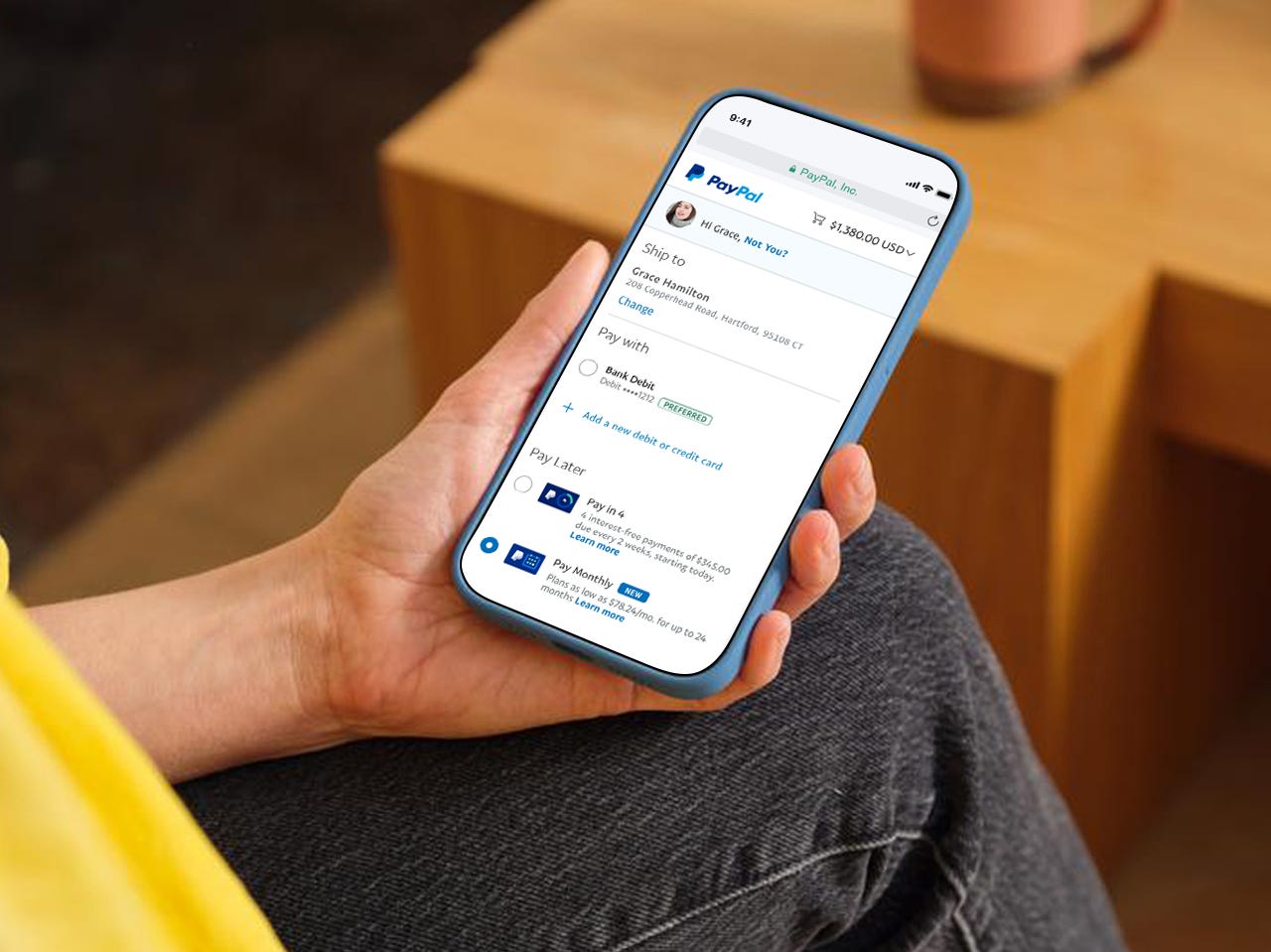

PayPal Holdings In its effort to create better ways to manage and move money while offering choices and flexibility when sending payments,PayPal Holdings said today it had launched its latest Buy Now, Pay Later (BNPL) product, PayPal Pay Monthly, issued by WebBank.

Pay Monthly will enable US consumers to spread payments over longer periods of time, up to two years. What's more, its customers will have access to a new offering through PayPal that will give them "greater flexibility and even more choices to pay for the items they want and need," according to the company's announcement.

With 537 million credit card accounts and debt totaling$841 billion in the US as of March 31, credit card debt is becoming a greater issue among many US consumers who are experiencing first-hand the effects of 40-year record inflation and rising interest rates and fears of an impending recession. As a result, many Americans are more cognizant towards saving, especially when it comes to making larger purchases. "As the macroeconomic environment continues to evolve, consumers are looking for ways to stretch their finances and have greater control over their purchases," Apur Shah, Senior Director Global Pay Later at PayPal, toldZDNetin an email.

Also: Buy Now, Pay Later: Flexible payments for inflationary times, or a road to debt?

PayPal's latest Pay Monthly BNPL offering is "a new way" for customers to make large purchases of between$199 and$10,000, allowing customers to break the total cost into more manageable monthly payments over a period between 6 and 24 months. The first payment is due one month after purchase, PayPal said.

Once a customer selects Pay Monthly, they will complete an application at checkout and, if approved, will be presented with up to three different plans of varying lengths with APRs ranging from 0% to 29.99%. Customers can then compare and select the option that best suits their budget.

"There is no one size fits all when it comes to making purchases -- and the same is true for the buy now pay later industry," Shah says. "We believe having a full portfolio of buy now, pay later plans -- in addition to our PayPal Credit revolving credit product -- allows consumers more choice to select the option that best suits their preferences and budgeting needs," he toldZDNet.

Also: PayPal Cashback Mastercard review: Earn unlimited rewards while you shop

Just like PayPal's other BNPL offering,Pay in 4 , Pay Monthly has no late fees and enables consumers to choose their repayment method and select automatic payments up front when completing their transaction. With Pay Monthly, customers have the option to choose between using their debit card or bank account for repayment and have the ability to manage and track payments through its PayPal app and online.?In addition, purchases are backed by PayPal's Purchase Protection. Customers will have the option to select Pay Monthly for their shopping needs at millions of retailers, including brands like Outdoorsy, Samsonite, Fossil, and Advance Auto, according to the company.

But keep in mind the fine print: Pay Monthly is subject to credit approval, and the APR ranges based on consumer credit eligibility, and that terms and availability may vary based on the merchant and purchase amount and may not be available in all states. "Pay Monthly plans do incur interest and are transparent about what the cost of each payment is and when they are due," says Shah. "PayPal provides regular communication regarding upcoming payments, the amount due, and when the payment is made."

For merchants, Pay Monthly will be available at no additional cost or risk and won't require back-office integration to add as a payment option, PayPal says. And similar to Pay in 4, merchants can also add dynamic messaging to deliver "Pay Later" options that are presented early in the customer's shopping experience, informing them that they will have the option to spread out payments at checkout, according to the company's announcement.

Hot Tags :

Our process

Finance

Banking

Hot Tags :

Our process

Finance

Banking