Graphics chip powerhouse Nvidia this afternoon reported fiscal Q3 revenue and profit that both topped Wall Street's expectations, and an outlook for this quarter's revenue that was higher as well, driven by record sales of chips for data centers, especially those that crunch artificial intelligence programs.

However, revenue from chips used for crypto mining plunged, the company said.

The report sent Nvidia shares up almost 4% in late trading.

During the evening's conference call with analysts, CEO and co-founder Jensen Huang said that his company has been able to secure supplies of its chips from its contract manufacturer, but that the global supply chain situation is a "wake-up call."

"We have a secured guaranteed supply, very large amounts of it, quite a spectacular amount of it, from the world's leading foundry, and substrate and packaging and testing companies that are an integral usual part of our supple chain," said Huang.

"So we have done that and feel very good about our supply situation, particularly starting the second half of this year and going forward."

Added Huang, "I think this whole last year was a wake-up call for everybody to be much more mindful about not taking the supply chain for granted, and we were fortunate to have such good partners. But nonetheless, we've secured our future."

Revenue in the three months ended in October rose 50%, year over year, to$7 billion, yielding a net profit of$1.17 a share, excluding some costs.

Analysts had been modeling$6.82 billion and$1.11 per share.

In a separate release with comments by Nvidia's CFO, Colette Kress, the company gave additional financial details.

In prepared remarks, Huang called the quarter's results "outstanding," noting the company had "record revenue" for its data center chips.

Added Huang, "Demand for NVIDIA AI is surging, driven by hyperscale and cloud scale-out, and broadening adoption by more than 25,000 companies.

Huang mentioned the company's GTC event last week, noting it "was our most successful yet, highlighting diverse applications, including supply-chain logistics, cybersecurity, natural language processing, quantum computing research, robotics, self-driving cars, climate science and digital biology.

He also called out the company's efforts pertaining to The Metaverse, noting "Omniverse was a major theme at GTC," adding, "We showed what is possible when we can jump into virtual worlds."

Omniverse will be used from collaborative design, customer service avatars and video conferencing, to digital twins of factories, processing plants, even entire cities. Omniverse brings together NVIDIA's expertise in AI, simulation, graphics and computing infrastructure. This is the tip of the iceberg of what's to come.

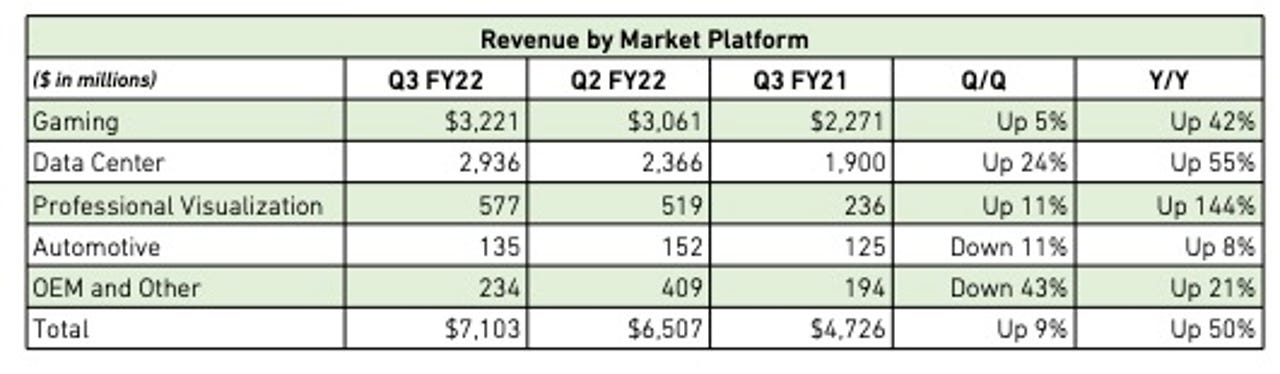

Within market segments, Nvidia's revenue from gaming products was$3.22 billion, up 42%. Revenue from data center chips was$2.94 billion, up 55% from the prior-year period, and up 24% from the prior quarter.

Nvidia's revenue in the category of "OEM" and other fell 43% from the prior quarter, and 21% from the year-earlier period, to$234 million. The company attributed the plunge to slower sales of its chips for mining crypto-currencies:

OEM and Other revenue was up 21 percent from a year ago and down 43 percent sequentially. The year-on- year growth reflects Cryptocurrency Mining Processor (CMP) revenue of$105 million in this quarter. The sequential decline primarily reflects lower CMP revenue.

Products for professional visualization brought in$577 million, an increase of 144%. And revenue from the automotive market brought in$135 million, an 8% increase from the year-earlier period and an 11% decline from the prior quarter's level.

Gross profit margin in the quarter, on a non-GAAP basis, rose to 67 versus 65.5% in the year-earlier quarter.

For the current quarter, the company sees revenue of$7.4 billion, plus or minus 2%, it said, versus consensus of$6.9 billion.

Nvidia expects gross profit margin to be between 66.5% and 67.5% this quarter.

Hot Tags :

Artificial Intelligence

Innovation

Hot Tags :

Artificial Intelligence

Innovation