Ericsson has agreed to acquire Voice over IP (VoIP) and B2B communications provider Vonage for$0.21 per share, or a total purchase price of approximately$6.2 billion. This represents a 28% premium over Vonage's share price at the close of the most recent trading day.

If you need to replicate a traditional office phone PBX remotely, we have recommendations to get you talking.

Read nowAccording to Ericsson's President and CEO B?rje Ekholm, the transaction is his company's "next step" toward "putting the power and capabilities of 5G, the biggest global innovation platform, at the fingertips of developers."

While Vonage is best known as a VoIP company, Ericsson appears primarily interested in its cloud-based Vonage Communications Platform (VCP). The platform currently serves over 120,000 accounts and represents more than 80 percent of Vonage's revenue, Ericsson noted.

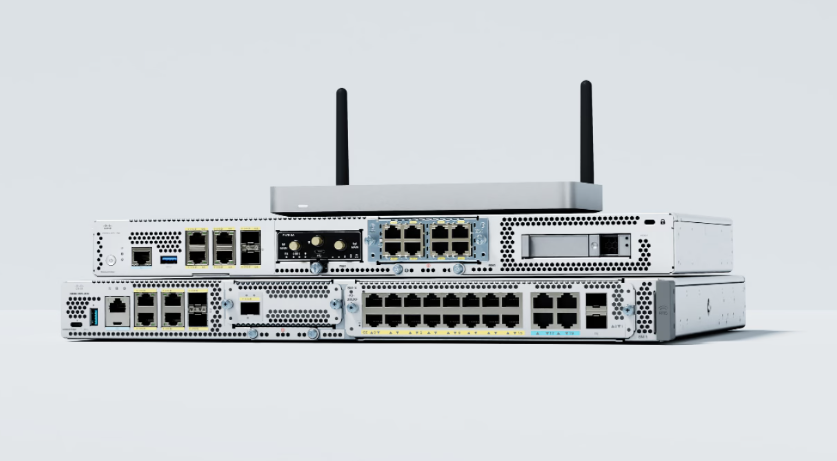

Ericsson also purchased Cradlepoint, an edge networking company, in 2020. Combined with the Vonage acquisition, Cradlepoint will help Ericsson create a growing presence in the Communications Platform as a Service (CPaaS) segment.

Ericsson's own predictions claim the CPaaS market will reach$22 billion annually by 2025, at which time it expects Vonage to be contributing$400 million to its annual revenue total.

Over the long term, Ericsson intends to leverage the "complementary solutions" brought together by the transaction to create a range of new solutions for telecom operations, developers, and businesses.

The transaction has already been unanimously approved by Vonage's Board, but it remains subject to the approval of its shareholders and all relevant regulatory authorities. The agreement is currently expected to close sometime in the first half of 2022, after which Vonage will be operated as a wholly-owned subsidiary under its existing name.

Hot Tags :

Business

Tech Industry

Hot Tags :

Business

Tech Industry