Tesla

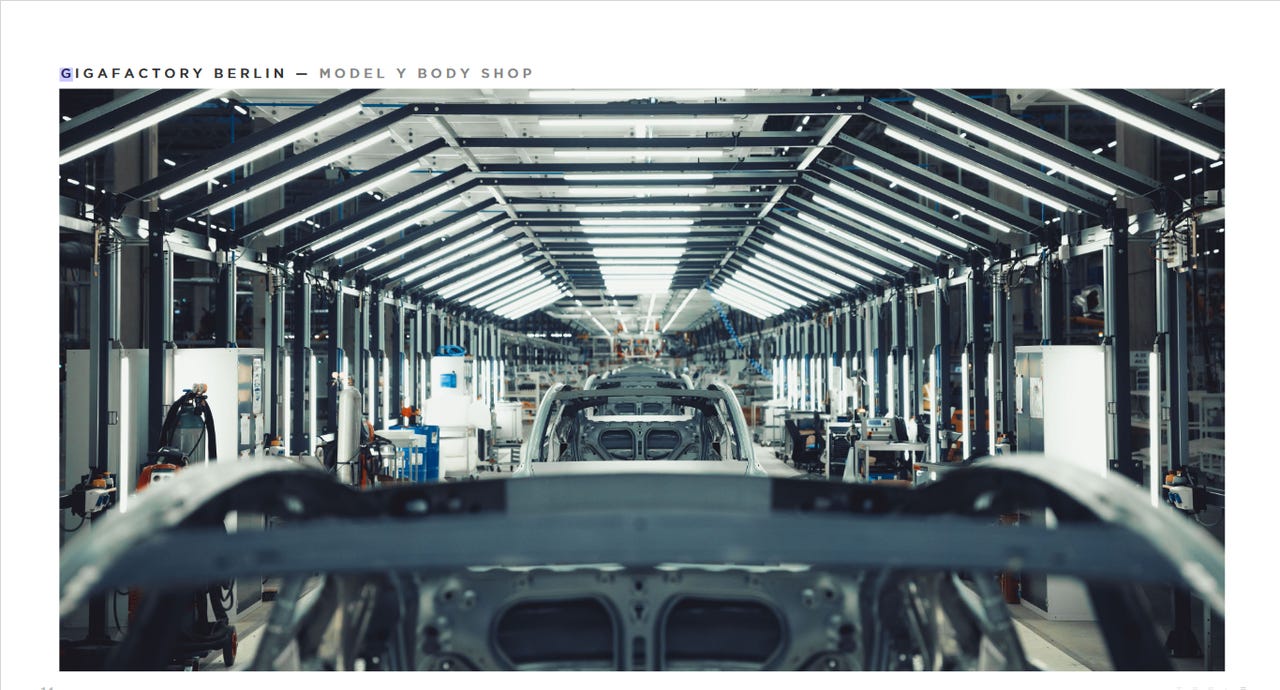

Tesla After a blockbuster first quarter for Tesla, with record revenues and car deliveries in Q1 2022, "it seems likely we'll be able to produce over 1.5 million cars this year," Tesla CEO Elon Musk said Wednesday during a conference call.

The forecast comes despite acknowledging that the company will face serious challenges for the rest of the year.

Musk said that the record results were achieved "despite a lot of chip shortages, many logistics challenges, and an overall difficult quarter," Musk said. "We remain confident of growth in vehicle production in 2022 versus 21. We actually have a reasonable shot at a 60% increase over last year."

Supply chain challenges have kept Tesla's factories running below capacity for several quarters, and the company doesn't see the situation improving this year.

"We plan to grow our manufacturing capacity as quickly as possible," Tesla said in its Q1 slide deck, adding that over a multi-year horizon, it expects to achieve 50% average annual growth in vehicle deliveries.

"The rate of growth will depend on our equipment capacity, operational efficiency and the capacity and stability of the supply chain," it continued. "Our own factories have been running below capacity for several quarters as supply chain became the main limiting factor, which is likely to continue through the rest of 2022."

To be sure, the challenges it's confronted this year didn't stop Tesla from having a stellar quarter. Earlier this month, Tesla announced it produced more than 305,000 vehicles and delivered more than 310,000 vehicles in Q1. That amounts to a 68% year-over-year increase in deliveries.

Total revenue came to$18.76 billion, up a whopping 81% year-over-year. Non-GAAP earnings per share (EPS) were$3.22, up 246% year-over-year. Those numbers eclipsed market expectations.

Meanwhile, Tesla's operating margin in Q1 shot up to 19%, which puts the company on par with supercar companies even though it's selling sedans and SUVs.

That said, the company is up against more than just supply chain disruptions. Transportation, labor and other manufacturing challenges have come into play and will likely affect the business throughout the year.

While weekly production rates at Tesla's Shanghai factory were strong in Q1, a spike in COVID-19 cases forced a temporary shutdown of the factory as well as parts of Tesla's supply chain. Given the situation in Shanghai, Tesla confirmed Wednesday it lost about a month of build volume. The company confirmed that limited production has recently restarted, and it continues to monitor the situation closely. It expects to be back to total build and delivery volume in Q2.

Amid those ongoing challenges, vehicle production in Q2 will be similar to Q1, Musk said Wednesday, adding, "maybe slightly lower." However, production in the second half of the year should be "substantially higher," the CEO said.

"I've never been more optimistic or excited about Tesla's future than I am right now," he said.

Musk also discussed the impact of inflation on the price of Tesla vehicles, noting that "suppliers are under severe cost pressure," in some cases requesting 20% to 30% increases for parts. Given that inflation "appears likely to continue for at least the remainder of this year," he continued, "that's why we raised our prices."

Higher prices account for the fact that Tesla has orders that go out a year or more in some cases, he explained. "We have to anticipate those cost increases."

Musk continued, "What's keeping costs down at least in the short term is that we have long-term contracts with suppliers. But those will run out, and then we'll start to see potentially significant cost increases."

The CEO said he doesn't anticipate raising prices further and that if probable cost increases do not materialize, the company may actually lower prices slightly.

Hot Tags :

Innovation

Transportation

Hot Tags :

Innovation

Transportation