The complexity of 'digital disruption' is challenging financial institutions to seek new ways to manage critical areas of their business. Banks know they must leverage new digital capabilities in order to satisfy consumer demand and maintain an optimal risk and expense structure.

Now more than ever, the customer is king. A bank's ability to offer a differentiated experience is the key to winning their loyalty. If banks want to gain the agility, innovation, and hyper-awareness needed to compete and win, they must start thinking AND ACTING differently. That means leveraging data - and the real-time insights derived through analytics - in impactful new ways.

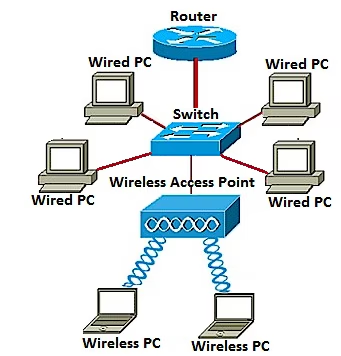

There is an explosion of data being created everywhere and it's very complicated. Data is useless without insight and action. And the most valuable data is that which reflects and enables the way you interact with your customers daily. A new era in customer experience insights is leveraging location-based analytics like traffic flow, balk and dwell times and device counts to understand and predict customer behavior within your branches.

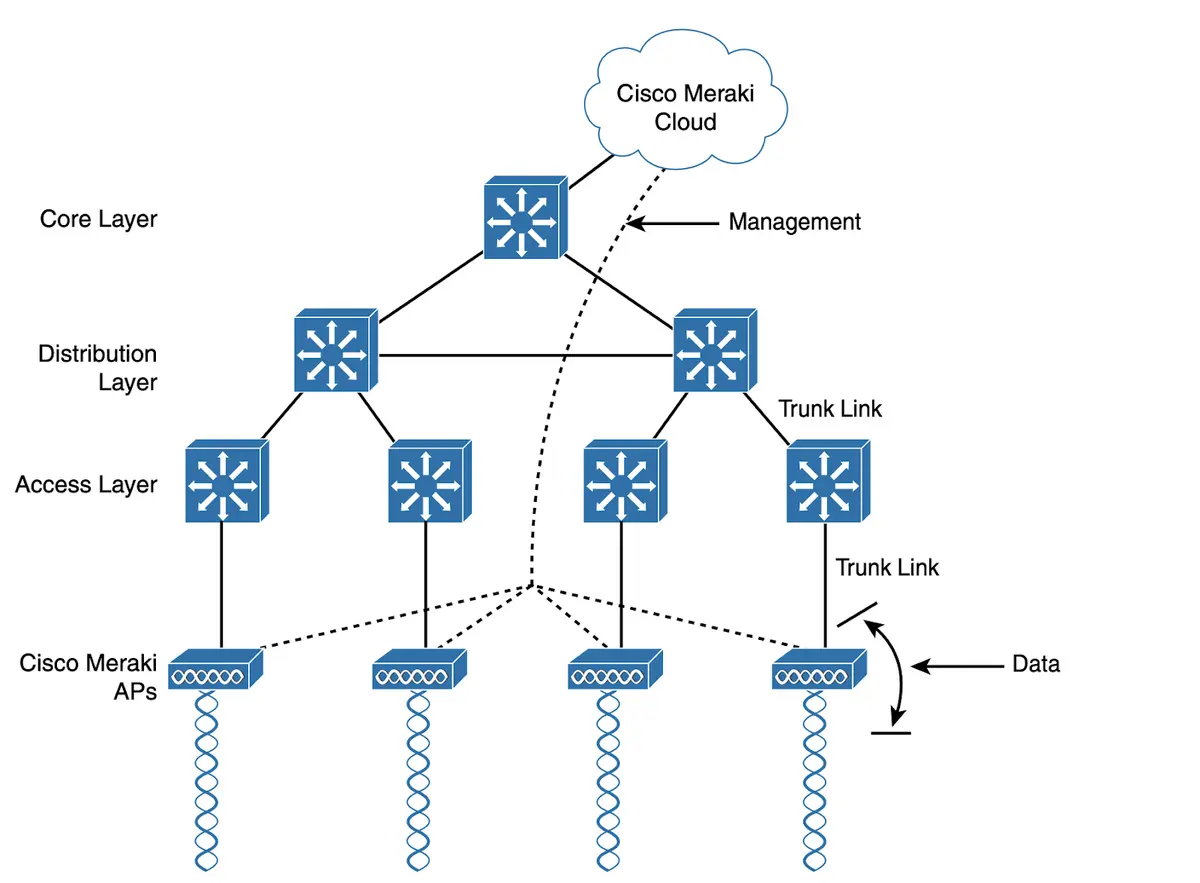

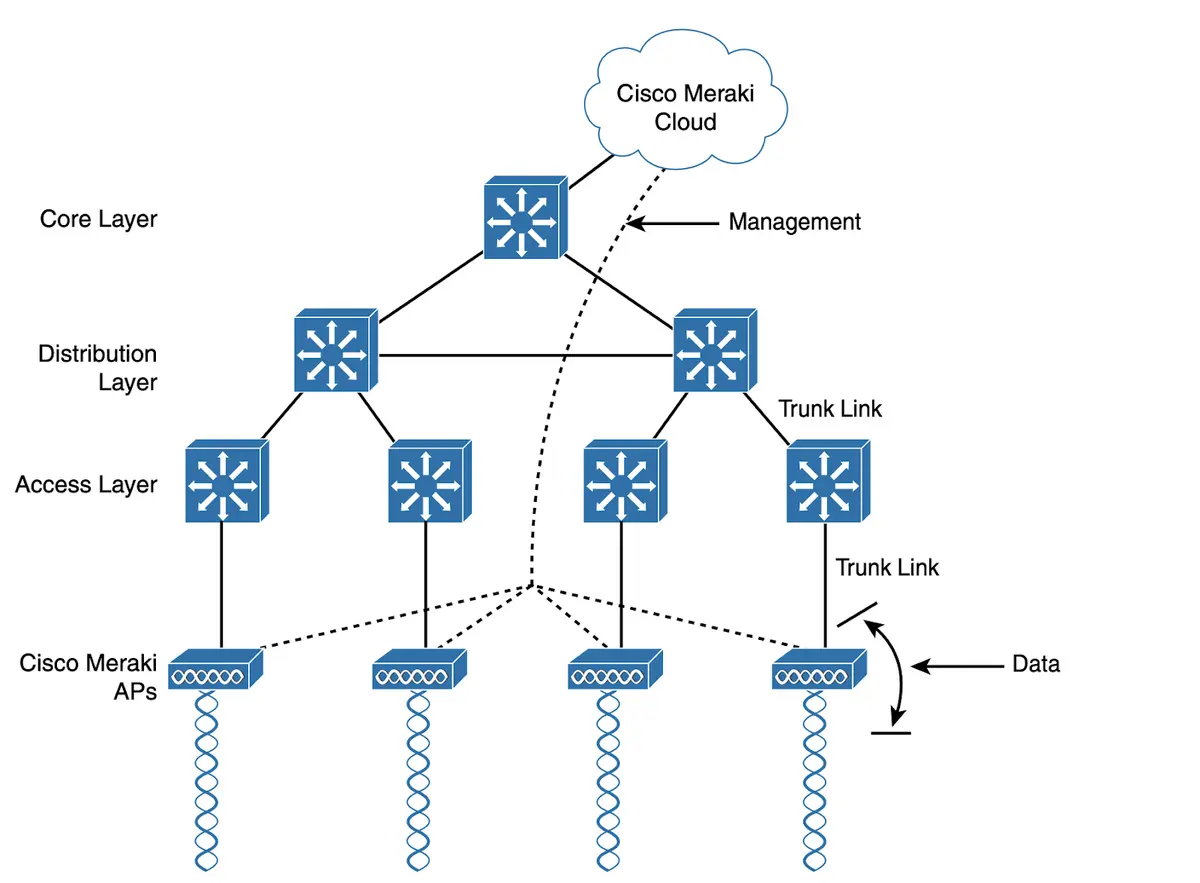

Cisco Meraki will deploy access points throughout the conference space at CBA LIVE 2016 in Phoenix, Arizona next week. CBA LIVE attendees will be able to view the location-based analytics dashboard in the middle of the show floor starting Monday, March 7th. This will be Cisco's first time at CBA LIVE and I'm looking forward to gathering all of the insights from the start of the show and highlight the results during my speaking session on Wednesday, March 9that 9 a.m. in Grand Canyon 1-3.

Today's financial institutions face an array of challenges - but many of these challenges are balanced by the exciting opportunities available to financial institutions that embrace digital business transformation by re-introducing human connectivity and leveraging digitization as a competitive advantage.

I look forward to meeting you next week at CBA LIVE! Follow @CiscoFSI on Twitter for updates from the conference.

Hot Tags :

Digital Transformation

Analytics

Banking

Financial Services Industry (FSI)

digital disruption

Hot Tags :

Digital Transformation

Analytics

Banking

Financial Services Industry (FSI)

digital disruption